T4 Slip: Deadlines, summary and what information employers need to include

- February 24, 2020

- Rahul Soni

- Employee Rights

- 0 Comments

Tax season is upon us! Hundreds of thousands of people around Ontario will be panicking about finding their ‘T4 form’. But what is the T4? Why is it so important? In this article we will explain your T4 and how important it is for filing tax. As an employee you should know what your T4 slip says. However, as an employer, it is essential that fill out the correct information for your employees.

What is the T4 slip?

The ‘T4 Statement of Remuneration Paid’ is an information slip/form filled out by an employer. It tells you and the Canada Revenue Agency what employment income you are paid in the tax year. It gives a detailed breakdown of income and tax that has been deducted.

Another slip is the ‘T4A Statement of Pension, Retirement, Annuity and Other Income’. This slip captures all other income that wasn’t covered by the T4. Pensions, retirement allowances, annuities and other incomes must all be filed under the T4A.

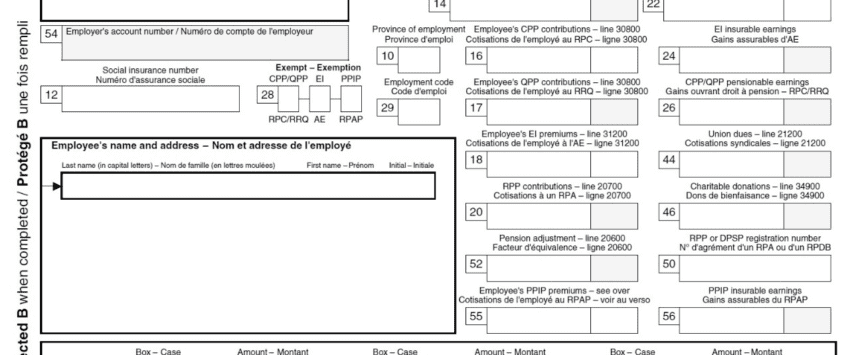

What information has to be included in the T4 slip?

An employer must include all information about the:

- Salary and wages

- Gratuities, tips and bonuses

- Vacation pay

- Commissions in the course of employment

- Insurable earnings and more

The T4 slip should also include information about taxable benefits, retiring allowances and deductions that were withheld during the year. Who all does an employer need to provide T4 slips for? If an employee received remuneration more than $500, and if CPP/QPP contributions, EI premiums, PPIP premiums or income tax had to be deducted, a T4 slip must be filed for them.

A T4 slip has to be filed regardless of when the services were performed or even if the employee is deceased.

What is the T4 summary?

Employers have to fill out the T4 summary. Essentially, this captures the total value of payments made in Canadian dollars towards T4 slips. A single T4 summary must be filled out for every payroll program account.

When must be T4s be submitted by?

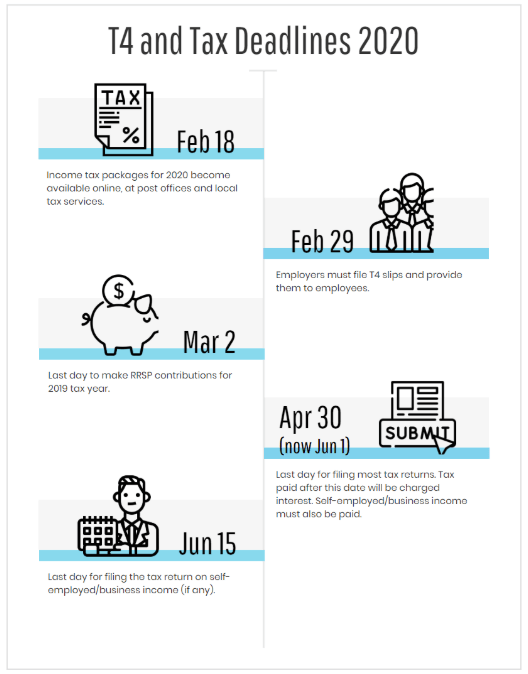

The deadline for employers to file and give their employees the T4 slip is 29 February 2020. Income tax must be filed by 1 June 2020. This deadline has been extended from 30 April due to the coronavirus and declaration of an emergency in Ontario.

Update: In light of the disruption caused by the coronavirus (COVID-19) outbreak, the Canada Revenue Agency has extended the deadline for filing income tax from 30 April to 1 June.

Read more

T4 vs Incorporate contract | Understand your pay stub | Ontario health benefits explained

Avoid these common T4 mistakes

T4 mistakes are usually about not adding benefits that are taxable. Here are three common benefits that are sometimes left out.

-

Insurance and health and wellness

If an employer pays to cover an employee’s life insurance, critical care insurance or other specialized insurance coverage, this must be included as a benefit. Even gym memberships, spas and massage programs must be paid for.

-

Commissions

If an employee receives commission income in their employment (such as someone paid sales income), the employer must demarcate it as such on the T4 slip. Failure to do distinguish it from regular income will limit what expenses (required to earn those commissions) the employee can deduct.

-

Allowances for vehicle/travel

If an employer offers allowances for a vehicle or private travel, this must be reflected in the T4 slip. These are all construed as taxable benefits.

Employment lawyers in Toronto

Soni Law Firm works with many employers in Toronto to offer opinion about structuring payroll and answering questions about T4 slips. If your employer is refusing to give you your T4 slip, speak to a Toronto employment lawyer immediately.