Your Pay Stub Explained

- October 26, 2019

- Rahul Soni

- Employee Rights

- 0 Comments

Who doesn’t wait for their ‘pay stub’ or ‘pay slip’. What was once a printed sheet of paper has become electronic for many, but the significance and importance of the pay stub cannot be understated. There are laws not just against not paying employees, there are laws about recording how much is paid too.

The pay stub is a crucial employment right for all workers. It empowers you, the employee, making sure you understand exactly how much you are earning. It lets you keep tabs on your employer if they are paying you less than what is owed.

What is a pay stub?

The pay stub is a wage statement. The Ministry of Labour, Training and Skills Development, Ontario requires pay stubs to be in writing. Moreover, they should include a breakdown of your wages and deductions. (We explain it all in greater detail below).

- Gross wages

- Net wages (how much you receive after deductions)

- Pay period and wage rate

- How many hours you worked

- Overtime pay

- Deduction for vacation pay

- Deductions – such as income tax, EI, Canada/Quebec Pension Plan, health benefits, professional fees and more

Pay stub or paycheque?

A pay stub records how you wages are calculated, a paycheque is a payment of those wages

Why are pay stubs important?

Pay stubs are an official record of your employment, for you and for your employer. It ensures that you are being paid what you are owed and the right taxes and fees are being withdrawn.

Pay stubs are legal proof of income and employment. Whether you are applying for credit (such as for a loan or credit card), applying for new employment opportunities, your pay stub will prove invaluable. At the end of the financial year, your pay stub is essential for checking that you have paid the right amount of tax.

More employment news

New laws that will reduce your overtime pay

Facebook recruitment ads fall foul of discrimination in hiring

The significance of the ‘equal pay for equal work’ laws

Who issues the pay stub?

The pay stub is issued by your employer. Whether you are a part time or full time employee, your employer is required to issue the pay stub. If you are employed by a company that has contracted out your services, for instance as a ‘temp’ or temporary worker, your pay stub may be issued by the temp agency or the company that is receiving your services, depending on the contractual arrangements.

What does the information in my pay stub mean?

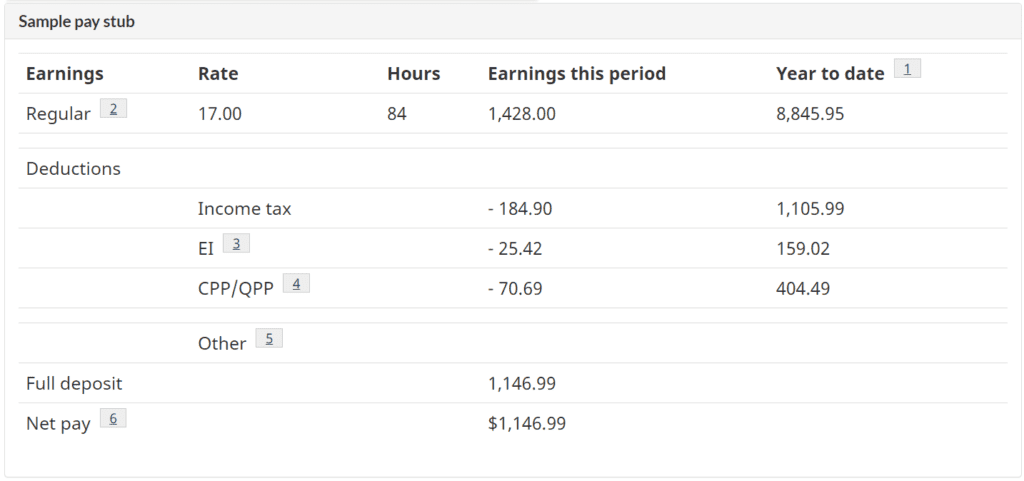

Source: Government of Canada

Pay stubs can vary from employer to employer, and even by province. However, a pay stub is required to mention certain information.

Gross income – This is a calculation of your total income – i.e. your hourly wage multiplied by the number of hours you have worked in the period the pay stub covers. It does not include any deductions, not even tax. Your real pay will usually be less than this. In the sample above it says ‘Regular’, however, it can include additional income for time on the road and the like.

Rate – The hourly rate you are paid at. There may be multiple rates for different work you perform for the employer (for instance, while travelling or for overtime).

Hours – How many hours you worked at each of the wage rates.

Year to date – The total gross income you have earned since the beginning of the financial year.

Deductions – Mandatory and other payments that must be made. Deductions are subtracted from gross income.

Income tax – Income tax calculated on the basis of what tax bracket you fall under.

Employment Insurance – EI contributions are made by employees and employers. EI makes temporary payments if you become unemployed or are unable to perform your duties to an accident.

CPP/QPP – The Canada Pension Plan or Quebec Pension Plan is a percentage of your gross income. As the name suggests, it is intended to provide pension income once you retire, or if you become disabled, or survivor benefits.

Health benefits/Fees/Premiums – If your employer provides health benefits, its own pension plan, or deducts professional fees, these will be mentioned as deductions too.

Net pay – Net pay is calculated after subtracting all deductions and taxes from your gross income. This is the amount you will receive.

Read about your employment rights

To understand what rights you have pertaining to your wages read more on the Ontario Ministry of Labour website. There are standards for overtime pay, what deductions can be made from your wages and about tips and gratuities. The page is geared for new workers and provides information simply.

Speak to a Toronto employment lawyer if you think your wages have been unlawfully withheld or reduced. An employer cannot unilaterally decide to lower your wages or make deductions without your consent.